The most cost-efficient source should be selected. Debt financing involves the borrowing of money whereas equity financing.

Types Of Financial Statements Bookkeeping Business Financial Statement Financial Accounting

Finance and accounting operate on different levels of the asset management spectrum.

. The basis for Comparison external vs. Lending money is an investment. 1 personal Personal FinancePersonal finance is the process of planning and managing personal financial activities such as income generation spending saving investing and protection 2.

Financial statement users are able to assess a companys strategy and ability to generate a. The statement of cash flows presents sources and uses of cash in three distinct categories. The main objective of all the above decisions is same which is profit maximization of business and wealth maximization of.

Generally funding and financing are interchangeably used in the financial world but there is a difference between these two terms. There are two types of financing available to a company when it needs to raise capital. According to Oswego University indirect financing is more important than direct financing methods.

Direct financing involves the companys borrowing of funds directly from investors. It can be evident from the following points. Equity financing and debt financing.

Financing is the decision of which resources or funds are to be brought into the business from external investors and creditors in order to be invested in profitable projects. This is due primarily to the added efficiency available through the financial. A financial investment is an asset that you put money into with the hope that it will grow or appreciate into a larger sum of money.

The dangers of starting a venture with the funds from various sources differ. An investment is an asset or item accrued with the goal of generating income or recognition. Although the basic decisions of finance includes three types of decisions ie.

Cash flows from operating activities cash flows from investing activities and cash flows from financing activities. Finance is generated within the business. The Scope and Focus.

The first external source of finance is debt which includes loans from banks and bonds purchased by bondholders. Financial assets are claims against the firm and thus appear as liabilities on the firms balance sheet. Internal sources are used when the requirement of funding is limited.

The buyer hopes that they will increase in value over time. In finance an investment is a financial asset bought with the idea that the asset will provide income further or. While real assets generate net income to the economy financial assets define the allocation of income.

Cash flows from operating activities cash flows from investing activities and cash flows from financing activities. The statement of cash flows presents sources and uses of cash in three distinct categories. Financial statement users are able to assess a companys strategy and ability to generate a profit and stay in business by assessing how much a company relies on.

Mostly investment decisions are irreversible while financing decisions are reversible. Differences Between Debt and Equity Financing. In an economic outlook an investment is the purchase of goods that are not consumed today but are used in the future to generate wealth.

Difference between Financing Decision and Investment Decision. The company pays the intermediary interest while the intermediary pays interest to its investors or depositors. Financing decisions revolve around how to pay for investments and expenses.

Financing decisions are all about allocation of funds and cost-cutting. Briefly explain the difference between internal control and internal control over financial reportingWhat are the major distinctions. Bonds and even savings accounts are loans that earn interest over time for the investor.

All value comes from the future. Companies can use existing capital borrow or sell equity. The primary goal of both investment and financing decisions is to maximize shareholder value.

Larger risk is linked with the funds which are borrowed than the equity. There are three main types of finance. The cost of raising funds from various sources differ a lot.

Investment decisions revolve around how to best allocate capital to maximize their value. Financing is lower risk and lower reward from the lenders perspective. Real assets represent the productive capacity of the firm and appear as assets on the firms balance sheet.

Differentiate between Operating Investing and Financing Activities. Funding is actually the money provided by companies or by a government sector for a specific purpose whereas financing is a process of receiving capital or money for business purpose and it is usually provided. The Sarbanes-Oxley Act requires public reporting on the quality of internal controls over financial reportingWhat are the primary benefits of such reporting.

Investing finance and dividend decisions but they are interlinked with each other somehow. Accounting provides a snapshot of an organizations financial situation using past and present transactional data while finance is inherently forward-looking. Finance is defined as the management of money and includes activities such as investing borrowing lending budgeting saving and forecasting.

The primary difference between Debt and Equity Financing is that debt financing is the process in which the capital is raised by the company by selling the debt instruments to the investors whereas equity financing is a process in which the capital is raised by the company by selling the shares of the company to the public. The finance is sourced from outside of the business. State the important differences between investment decisions and financing decisions Generally investment decisions have positive NPVs while financing decisions have zero NPV.

Investment implies ownership - which is another way of saying you own the troubles of the company and also will stike gold ifwhen the company does really well.

Three Types Of Cash Flow Activities

Pengantar Akuntansi 2 Ch13 Statement Of Cash Flow Cash Flow Cash Flow Statement Small Business Bookkeeping

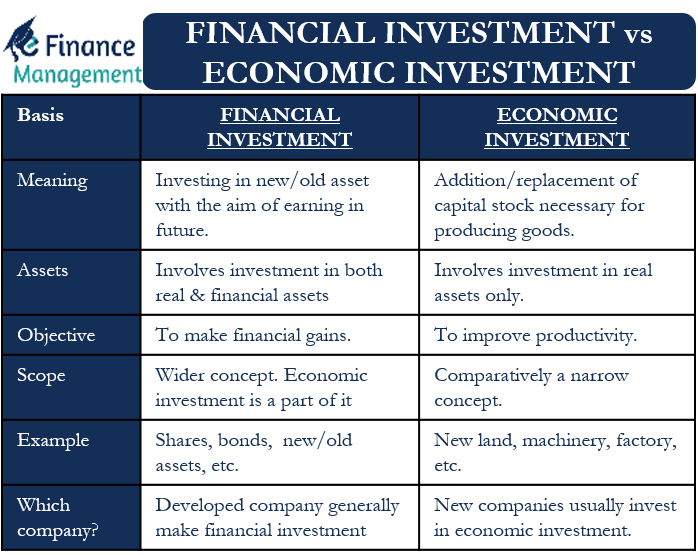

Economic Investment Vs Financial Investment All You Need To Know

Difference Between Investing And Financing Activities With Table Ask Any Difference

0 Comments